By Amos Odeh, Yenagoa

The Bayelsa government has announced tax relief 50 percent for the informal sector and other tax reliefs to residents and business operators to cushion the effect of the COVID-19 pandemic on tax payers

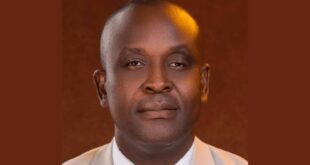

Dr Nimibofa Ayawei, executive chairman, Bayelsa Board of Internal Revenue in a statement issued in Yenagoa said that the tax reliefs approved by Gov Douye Diri are as a show of sensitivity to the adverse impact of the coronavirus pandemic.

According to him, part of the concessions granted by the government include the extension of the deadline for filing Form A returns for employee and annual returns to September 30 for companies and institutions operating in Bayelsa; a waiver of penalty and interest until August 31, 2020 for outstanding Pay-As-You-Earn (PAYE) remittances.

“A waiver of penalty for all outstanding tax issues up to December 2019, for which the undisputed amounts are paid within 30 days post interstate lockdown.

“A 50 per cent discount on the personal income tax assessment for the informal sector in the year 2020 as contained in the minimum harmonised tax rates in Bayelsa. A 35 per cent discount on pool betting tax for year 2020,” Ayawei stated.

PH Mundial – Port Harcourt Online Newspaper News across the Niger Delta

PH Mundial – Port Harcourt Online Newspaper News across the Niger Delta